Gujarat Hosts 53rd Lions International ISAME Forum 2025, Inaugurated by CM Bhupendra Patel

Gandhinagar – The 53rd Lions International ISAME Forum 2025 was inaugurated in Gandhinagar on Tuesday by Chief Minister Bhupendra Patel. The three-day global event is being held under the auspices of the International Association of Lions Clubs, bringing together more than 4,000 participants from ISAME member countries—spanning India, South Asia, and the Middle East—as well as representatives from the United States, Canada, Europe, Asia, and Africa.

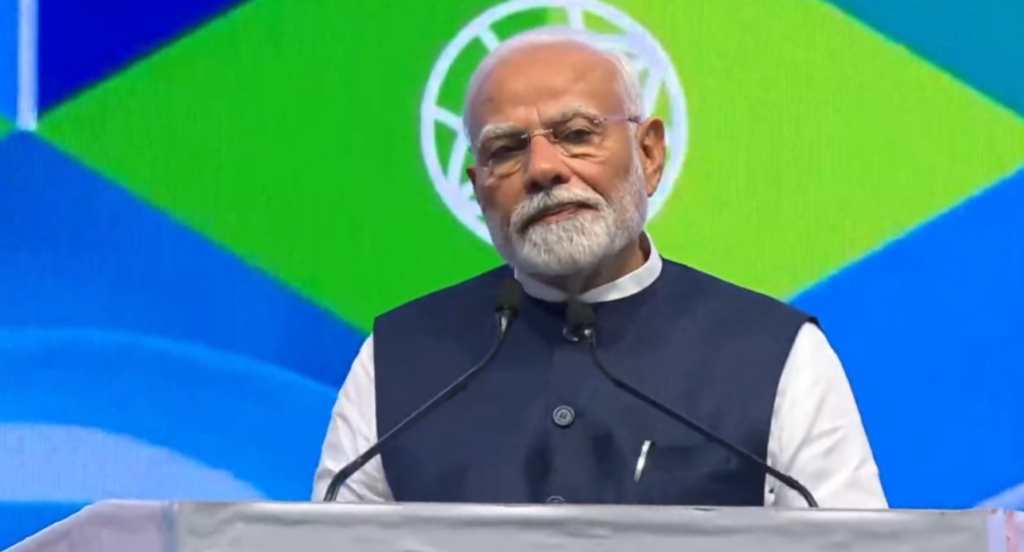

Addressing the gathering, CM Patel highlighted that hosting the forum in Gujarat reflects the state’s commitment to leadership, cooperation, and international goodwill. He said the event in the land of Mahatma Gandhi and Sardar Vallabhbhai Patel embodies the Indian ethos of “Vasudhaiva Kutumbakam”—the world is one family. The Chief Minister also underscored Prime Minister Narendra Modi’s vision of human-centric development, global collaboration, and using soft power to benefit humanity.

CM Patel expressed confidence that the forum would serve as a vibrant platform for motivation, innovation, and stronger service initiatives aimed at uplifting vulnerable communities. He noted that the event provides a timely opportunity to review the United Nations’ Sustainable Development Goals alongside Lions’ core service programmes and chart future action plans.

Lauding Lions International as a “lighthouse of service and leadership,” the Chief Minister highlighted the organisation’s global reach, with over 49,000 clubs across more than 200 countries and regions working collectively under the motto “We Serve.”

The forum also offered Gujarat an occasion to present itself as a model of socio-economic progress, strong infrastructure, and investment potential to the international community. Dignitaries present at the inauguration included Forum Chairman Pravin Chhajed, Lions International President A. P. Singh, senior BAPS saint Brahmavihari Swami, and other distinguished members of the Lions fraternity.

Source & Image Credit: CMO Gujarat