Bajaj Housing Finance IPO: Key Highlights and Listing Expectations

The highly anticipated Bajaj Housing Finance IPO is making waves in the financial markets as its shares are set to debut today, September 16. After a successful subscription period from September 9 to 11, the allotments were finalized on September 12, and investors are eagerly awaiting the stock’s performance on the exchanges.

IPO Details: Strong Fundraising and Share Structure

The Bajaj Housing Finance IPO was priced between Rs 66 and Rs 70 per share, raising a substantial total of Rs 6,560 crore. This includes a fresh issue of 50.86 crore equity shares valued at Rs 3,560 crore and an offer-for-sale (OFS) of 42.86 crore shares, generating an additional Rs 3,000 crore. With these figures, Bajaj Housing Finance has established itself as a major player in the financial space.

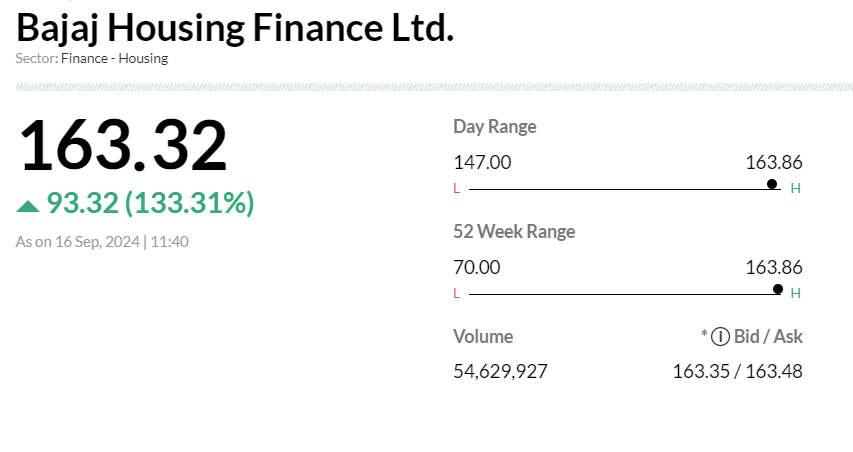

Strong Market Debut Expected: Could We See a 112% Premium?

As the shares make their market debut, all eyes are on the grey market premium (GMP), which suggests an estimated listing price of Rs 148 per share. This is a 112% premium over the issue price of Rs 70, sparking excitement among investors. Such a premium indicates robust demand and could deliver substantial returns to those who invested during the IPO.

Analysts Predict a 100%+ Gain for Investors

With a strong GMP of Rs 78 per share, market analysts are predicting a listing premium exceeding 100%, potentially doubling the returns for investors. The shares are trading Rs 82 higher in the grey market compared to the IPO price, reflecting high demand and positive sentiment ahead of the official listing.

Listing on BSE and NSE: A Day to Watch

Today marks the official listing of Bajaj Housing Finance shares on both the BSE and NSE, with investors eagerly anticipating a strong debut. Following the overwhelming response to the IPO, the market is set for an exciting day as Bajaj Housing Finance establishes its presence on the stock exchanges.

Stay tuned for further updates as Bajaj Housing Finance makes its much-awaited market debut!