Ola Electric Stock: A Closer Look at Its Latest Market Performance

Ola Electric, a key player in India’s electric vehicle (EV) revolution, has been making headlines recently not just for its innovative products but also for its notable performance in the stock market. The company, which started as a ride-hailing service and expanded into the electric scooter market, has quickly become a significant force in the EV industry.

The Rise of Ola Electric

Ola Electric entered the EV market with the launch of its electric scooters, the Ola S1 and S1 Pro, which were met with overwhelming demand. The company positioned itself as a leader in the Indian EV space by offering stylish, affordable, and environmentally friendly alternatives to traditional two-wheelers. Its aggressive pricing, combined with innovative features like keyless entry, reverse mode, and multiple riding modes, helped Ola Electric capture a significant share of the market.

This success in the consumer market has translated into investor confidence, as reflected in the company’s stock performance.

Ola Electric Stock Market Performance

Ola Electric’s stock market journey has been closely watched by investors and analysts alike. Following its initial public offering (IPO), the company saw a surge in stock prices, driven by high investor interest and optimism about the future of EVs in India. The stock’s upward trajectory has been fueled by several factors:

- Strong Sales Figures: Ola Electric reported impressive sales figures for its scooters, particularly the S1 Pro, which quickly became one of the best-selling electric scooters in the country. The strong consumer response has bolstered investor confidence, leading to a positive impact on the stock price.

- Expansion Plans: The company’s ambitious plans to expand its product lineup and enter new markets have also played a role in its stock market success. Ola Electric has announced its intentions to launch electric motorcycles and electric cars in the near future, further enhancing its growth potential.

- Government Support: The Indian government’s push for electric vehicles through subsidies and incentives has provided a favorable environment for companies like Ola Electric. The supportive regulatory framework has encouraged investment in the EV sector, which in turn has benefited Ola Electric’s stock.

- Sustainable Energy Focus: Investors are increasingly drawn to companies that prioritize sustainability, and Ola Electric’s focus on renewable energy and reducing carbon emissions aligns well with this trend. The company’s efforts to build a comprehensive charging infrastructure and explore battery swapping technology have also added to its appeal.

Close Look on Ola Electric Stock Performance:

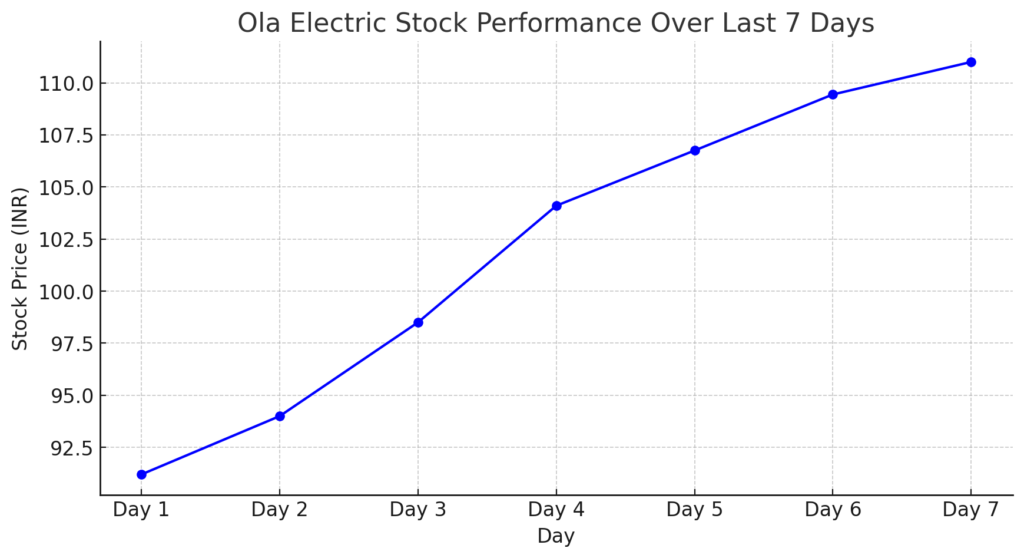

Ola Electric has been making waves in the stock market recently, with a significant uptick in its stock performance following its debut on August 9, 2024. Over the past seven days, Ola Electric’s stock has seen remarkable growth. The stock price jumped from Rs 91.20 to Rs 111 by August 15, marking an increase of over 20%. This surge reflects strong investor confidence and positive market sentiment towards the company’s future prospects.

In its first-ever quarterly report as a public entity, Ola Electric reported a revenue of Rs 1,644 crore for Q1 FY25, a 2.9% increase compared to the previous quarter. The company also managed to reduce its losses by 16.6% during the same period, demonstrating effective cost management. Ola Electric continues to dominate the electric two-wheeler market in India, with a market share of 39% in July 2024.

Looking ahead, leading financial brokerages predict that Ola Electric’s stock could continue its upward trend if the company successfully expands its product lineup and market presence. The upcoming launch of its first electric motorcycle on Independence Day is anticipated to further bolster its market position.

Here’s a graph summarizing the last seven days of stock performance:

Given the current momentum and strategic developments, Ola Electric’s future in the stock market appears promising, with analysts watching closely for the company’s next moves and performance in the upcoming quarters (Entrackr) (Outlook Business).

Challenges and Future Outlook

Despite its recent success, Ola Electric faces several challenges that could impact its future stock market performance. The company needs to navigate supply chain disruptions, competition from established players, and the ongoing development of its manufacturing capabilities. Additionally, the broader economic environment and fluctuations in raw material costs could affect profitability.

However, Ola Electric’s strong brand presence, commitment to innovation, and strategic investments position it well for future growth. As the demand for electric vehicles continues to rise, the company is expected to remain a key player in the market, with its stock likely to be a significant point of interest for investors.

Conclusion

Ola Electric’s stock market performance reflects the growing interest and confidence in the electric vehicle sector in India. With its strong sales, ambitious expansion plans, and focus on sustainability, the company has established itself as a leader in the EV market. While challenges remain, the future looks promising for Ola Electric as it continues to drive the shift towards cleaner and more sustainable transportation options in India.

Disclaimer: The views and recommendations above are those of ai generated, individual analysts or broking companies, not Gujarat360. We advise investors to check with certified experts before making any investment decisions.